Since the United Kingdom’s decision to leave the European Union, commonly known as Brexit, global trade has experienced a series of shifts and adjustments. From reshaping trade policies to influencing economic relations across continents, Brexit has had a wide-ranging impact on the global economy. This article explores how Brexit has altered trade dynamics, affected key sectors, and created new opportunities and challenges for businesses and countries worldwide.

1. Overview of Brexit’s Economic Impact

Brexit officially took effect on January 31, 2020, and the UK fully exited the EU's single market and customs union at the end of 2020. The separation was a historic event, altering established trade relationships that had been in place for over 40 years. The impacts are still unfolding, but key changes are evident, including:

- New Trade Barriers: With the UK outside the EU customs union, there are now tariffs, quotas, and regulatory checks on goods moving between the UK and the EU.

- Regulatory Divergence: The UK is free to establish its own regulatory standards, potentially diverging from EU policies. This could lead to complications for businesses that export to both markets.

These changes have not only affected the UK and the EU but also disrupted trade networks and supply chains that reach far beyond Europe.

2. Impact on Key Sectors

Brexit has particularly impacted certain industries that rely heavily on cross-border trade between the UK and the EU:

- Automotive Industry: Automakers depend on a seamless supply chain between the UK and the EU. New trade barriers mean added costs, delays, and challenges in sourcing parts, which has led some manufacturers to relocate parts of their operations.

- Agriculture and Food: The agriculture and food sectors have faced significant challenges due to increased tariffs and customs checks. Perishable goods are especially affected, with delays leading to spoilage and increased costs.

- Financial Services: London was historically one of the world’s top financial hubs. However, Brexit has prompted some banks and financial institutions to move operations to EU cities like Frankfurt and Paris to maintain access to the single market.

These changes have forced businesses to rethink their operations, adapt to new regulations, and, in some cases, pass on additional costs to consumers.

3. Global Supply Chain Disruptions

Brexit has introduced complexities into global supply chains that extend beyond Europe:

- Increased Costs and Delays: Customs checks and regulatory compliance requirements have increased the time and cost of transporting goods between the UK and EU. For global companies that use the UK as a gateway to Europe, these added expenses disrupt pricing and inventory management.

- Logistics and Shipping Adjustments: Some global firms have restructured their supply chains, shifting warehouses and distribution centers to mainland Europe. This shift has created new logistical strategies but also adds expenses related to infrastructure development and workforce relocation.

- Impact on Non-EU Trade Partners: Countries outside the EU that previously used the UK as a bridge into Europe must now reconsider their trade routes and possibly renegotiate trade agreements.

4. Trade Agreements and New Partnerships

Brexit has allowed the UK to pursue independent trade agreements, reshaping its relationships with countries around the world:

- New Free Trade Agreements (FTAs): The UK has negotiated several trade deals with countries such as Japan, Australia, and New Zealand, aiming to establish stronger ties outside the EU. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is another notable example.

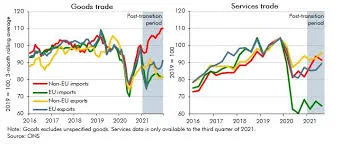

- Adjustments to EU-UK Trade Relations: The UK-EU Trade and Cooperation Agreement (TCA) is the foundation for post-Brexit trade between the UK and the EU. However, it primarily covers goods, meaning services, an area where the UK has a trade surplus, remain subject to various restrictions.

- Renegotiating Relationships with Developing Countries: Brexit has led the UK to focus on building trade relationships with emerging markets in Asia, Africa, and Latin America, aiming to diversify its trade portfolio and tap into high-growth regions.

These new partnerships are a step toward mitigating the trade impacts of Brexit, although building these relationships and overcoming trade barriers will take time.

5. Economic Implications for Global Markets

The broader economic implications of Brexit have been felt in both established and emerging markets:

- Currency Volatility: The British pound has experienced fluctuations since Brexit, affecting exchange rates and investment returns globally. Businesses reliant on UK exports have had to adjust to these fluctuations, impacting pricing and profitability.

- Investment Uncertainty: Brexit created uncertainty for global investors, leading some to relocate funds to more stable markets. While the UK remains a significant investment destination, investor caution has reshaped investment flows in sectors like technology, finance, and real estate.

- Impact on Small and Medium Enterprises (SMEs): Smaller businesses, particularly those that rely on imports from or exports to the UK, have faced challenges due to increased tariffs and the complexity of trade regulations.

These factors contribute to a cautious global investment climate, as businesses and governments monitor Brexit’s long-term impact on trade and investment.

6. Future Outlook and Potential Opportunities

Despite the challenges, Brexit also presents new opportunities:

- Innovation in Trade Policies: The UK can create more flexible trade policies tailored to its economic needs, potentially becoming a pioneer in digital trade or green technology agreements.

- Investment in Emerging Markets: Brexit has encouraged the UK to seek partnerships in fast-growing economies, creating opportunities for businesses in markets outside the EU.

- Tourism and Global Talent: Post-Brexit policies have also led the UK to attract a more global talent pool and invest in tourism promotion, aiming to boost its international profile and economic growth.

The long-term effects of Brexit on global trade are still evolving, but the separation has undoubtedly led to a shift in trade relationships, providing challenges and new pathways for international cooperation.

No comments: